Financial planning: a game of strategy

How to make sure you’ve got all your pieces in play

Many people neglect to have a financial plan in place when it comes to retirement. Yet, making provision for it is key to being able to enjoy life and retain financial independence when you finally give up work.

But with fluctuating trends and so many economic uncertainties, where do you start?

Begin with a thorough, holistic evaluation of your current financial state and future expectations – you can do this on your own or with the help of a certified financial planner. Remember that a holistic assessment must take your total overall financial situation into account. This means that in addition to any retirement annuities, investments and savings, it is essential to also include the total capital that you have contributed to date to your employer’s pension or provident fund and any further value-add benefits that the fund may offer. Furthermore, you also need to take into account what debt you have and where and how you would like to retire one day. The desired location of your retirement is important because should you plan to move overseas, for example, there may be different considerations to those should you intend to retire locally. In other words, when putting your financial plan into place, it should provide you with a “big picture” view of all future revenue streams and any present debt.

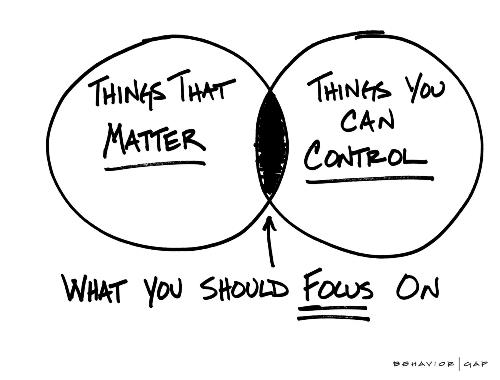

It is, therefore, worthwhile taking the time when undertaking such an important exercise, to get rid of all the clutter and “noise”. Take, for example, unsolicited advice from friends and family, social media hype and even the myriad investment offers from financial institutions - all of which can distract one and create uncertainty when it comes to making financial decisions. Rather focus on the things that matter, what is important to you, what the goals are that you need to achieve for your retirement versus what it is that you can control (as the diagram below illustrates) and once you have translated it into your financial plan, stick with it.

How does this tie into financial planning you might ask? Well, financial planning is simply a matter of identifying the areas in your life that matter most to you and then planning accordingly.

Some of the areas you might want to look at include:

- Assets: Do you own assets such as a house, contents or car and are they properly insured?

- Medical Aid and GAP Cover: Are you a member of a private scheme and do you know and understand your benefits and what is covered?

- Family: Do you have dependants and have you considered how they will be affected (financially) in case of death or if you are disabled or retrenched?

- Debt: What is your situation? Will your debt be covered in the event of death and disability and, will it be settled before your retirement?

- Will: Have you made sure your dependents are sufficiently looked after in the event of your death?

- Tax: Careful planning could result in less tax payable - consider getting professional help even if just consulting with a tax practitioner once.

- Company and/or Trust: Discuss your options with your advisor and how this ties in with risk and estate planning.

- Emergency funding: COVID highlighted the importance of having a nest egg, especially for those whose income was impaired.

- Retirement: Planning is key so that your portfolio may be structured to accommodate day-to-day expenses, as well as additional costs that may be associated with downsizing.

- Risk cover: Does your current policy offer sufficient cover to meet your requirements should need it?

- Risk cover post-retirement: Many people invest in risk cover but upon retirement, can no longer afford the premiums and decide to cancel their policy. Should you wish to continue risk coverage after retirement, it is worth considering a product now where your premiums stop at retirement date whilst your coverage continues. This is a great benefit which will ensure you need less income when you retire and thus, merits paying the premiums now.

- Investments: Discretionary investments can be made across various investment options and vehicles. This includes direct offshore investments in different currencies e.g., sterling, US dollar and euros to name a few

Think of financial planning as playing chess. If you move a piece; it helps if another piece is in place to back it up. Take the time to understand where you are in life. Talk to your advisor if you need help to get perspective but be sure to critically look at your numbers, adjust course, if necessary, but most importantly, don’t let yourself be swayed by short-term noise.

Before you know it, you’ll be at retirement age or already retired and using the capital you saved to provide an income. That is why making sure you have a plan in place to help you achieve your retirement goals is so important so that you can afford to live the life you envisaged and deserve.